Hits:Updated:2022-10-28 14:10:32【Print】

From May of this year to now, there have been endless incidents of thunder explosion or road running of XX freight forwarder. Two days after the incident of "leaving the freight forwarding agency to set up a chain", two thunderstorms occurred in the freight forwarding circle.

8 US counters, which have not been mentioned since they arrived at Hong Kong for more than 70 days

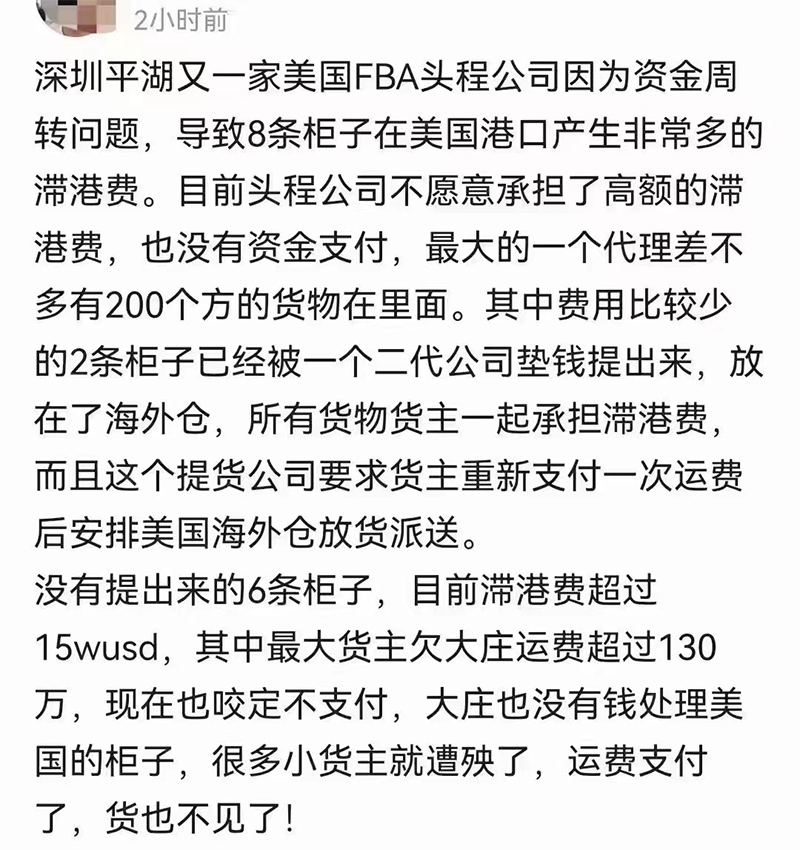

Recently, a company in Pinghu, Shenzhen, which is the first step of the US FBA, has detained eight cabinets in US ports due to the problem of capital turnover, six of which have not been mentioned so far, and demurrage has exceeded 125000 dollars.

According to netizens, this US FBA First Engineering Company is unwilling and unable to bear the high demurrage.

At the same time, this FBA first process enterprise has undertaken the entrustment of many freight forwarding peers, among which the largest freight forwarder has nearly 200 cubic meters of goods in these stranded cabinets.

It is understood that two of the cabinets with relatively low cost have been put in overseas warehouses by a second-generation company.

However, this second-generation company requires all the cargo owners to bear the demurrage together, and requires the cargo owners to pay the freight again before arranging the release and delivery of goods from overseas warehouses in the United States.

Up to now, there are 6 containers at the port that have not been raised, and the demurrage has exceeded 125000 dollars (about 900000 yuan).

It is understood that the port of departure of these six cabinets is Shenzhen Yantian Port, and the port of destination is New York and Los Angeles Port respectively. The sailing time varies from early July to early August, and they arrive at the port of destination around the middle of August.

In addition, at present, there are 4 cabinets that have been detained at the port for more than 70 days, and demurrage charges are still increasing.

It is worth noting that among the goods that have been detained for a long time, the largest owner owed more than 1.3 million freight to Dazhuang, and was reluctant to pay. With Dazhuang's funds blocked, it was unable to handle American cabinets, which led to the small owners' "paying for freight and then selling goods", which caused heavy losses.

Many relevant practitioners said that the freight forwarder was unable to bear the demurrage charges, and might also have to jointly bear the demurrage charges, overseas warehouse storage fees and US delivery fees, etc. The seller was finally injured.

Suspected capital chain breakage of cargo agency

Many shippers were involved

In addition, a freight forwarder in East China also experienced thunderstorms.

Recently, a netizen reported that a freight forwarding company in Shanghai owed a lot of money to the shipping company due to the problem of capital turnover, which led to the involvement of many shippers and freight forwarding peers downstream.

According to a statement, freight forwarder A turned to the owner of the goods and hoped that the owner could pay the ocean freight in advance to purchase the bill of lading in order to avoid high costs at the port of destination when he failed to release the documents after the second payment.

The statement is as follows:

Our company (freight forwarder A) got to know Mr. Tan, the leader of freight forwarder B, in June this year. After Mr. Tan told us that one of his sons was in the internal management of a shipping company, we confirmed that the situation was true, and we trusted and entrusted freight forwarder B to book space in the shipping company.

During the National Day holiday, we had many bills of lading stuck in the issue of release. We kept contacting freight forwarder B to solve the problem, but failed to release the bill. It was confirmed that there was a problem with freight chain of freight forwarder B. As of September, we had paid freight forwarder B all in time. Later, we paid another 90,000 dollars to the shipping company due to the customer's urgent demand, but we did not release the bill. The reason was that freight forwarder B owed more money and needed to settle all before releasing the bill.

Your company (cargo owner) booked two Xiamen New York shipping spaces in our company in September, and we also paid the freight forwarder B within 3 days after the ship opened. Now freight forwarder B has not paid freight to the shipping company. Even if we make a second payment, we can't release the bill. In order to avoid high expenses at the port of destination, we hope you can pay the shipping company directly to purchase the bill of lading first.

With the intensification of industry competition, some freight forwarders have limited ability to grasp freight rates and other costs, and cannot cope with difficulties. The originally fragile capital chain will break. It is not surprising that the explosion in the above cases occurs.

In recent years, the freight forwarding industry has been mixed, and many freight forwarding enterprises have also warned their peers and shippers that the freight forwarding service is multi-dimensional, only chasing low prices, and may also be swallowed by low prices. Finally, they lose their wives and lose their troops.

For the above two mine blasting incidents, the involved cargo owners and freight forwarders should negotiate and deal with them as soon as possible, otherwise, with the delay of the incident, the storage fees generated by the terminal will increase geometrically.

|